does wyoming charge sales tax

An example of taxed services would be one which sells repairs alters or improves tangible physical property. This is the same whether you live in Wyoming or not.

Wyoming Real Estate Tax Benefits Jackson Hole Real Estate Mercedes Huff

Wyoming is a destination-based sales tax state.

. It is also the same if you will use Amazon FBA there. Jul 10 2021. You can view your total monthly charge in the.

Whether you must charge your customers out-of-state sales taxes comes down to whether youre operating in an origin-based sales tax state or a destination-based sales tax state. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. Throughout Alaska many of their counties known as boroughs do charge sales tax.

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. Resources Blog SaaS. Does Wyoming have sales and use tax.

However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. Tax rate charts are only updated as changes in rates occur. When applicable these taxes are collected by Hulu and are then remitted to the jurisdiction that is assessing the tax.

How to Calculate Property Taxes in Wyoming. Sales Tax Exemptions in Wyoming. In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and.

This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not. However when part of the sale price of a taxable sale the charges are generally taxable. To learn more see a full list of taxable and tax-exempt items in Wyoming.

In certain jurisdictions Hulu is required to charge tax on our services in order to comply with your state and local laws. For example Juneau Borough charges a 5 sales tax on eligible purchases and it collected over 47 million in. The states biggest slice of the tax pie came from property taxes which made up 38 percent.

If the vendor presents the invoice to the consumer as 170 for the shampoo and 025 for a separately stated delivery fee then only the 170 is subject to Wyoming sales tax. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

Sales tax 101 Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. Any sales tax collected from customers belongs to the state of Wyoming not you.

While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs alterations or improvements to tangible personal property in the scope of those services. Several other states such as Delaware South Dakota and Washington tax some services.

The process of determining which tax rates apply to individual purchases is referred to as sales tax sourcing and it can be somewhat complicated to figure out. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. There are currently five states that have no sales tax at all Alaska Delaware Montana New Hampshire and Oregon.

In Laramie County the average tax rate is a bit higher at 065. That means a home assessed at 250000 in that county would pay just 1615 a year. By Jennifer Dunn February 13 2018.

This is based on your billing address. State wide sales tax is 4. We advise you to check out the Wyoming Department of Revenue Tax Rate for 2020 PDF which has the current rates.

As more and more of the world goes digital the question of whether or not to charge sales tax on digital products plagues more business owners. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. The state sales tax rate in Wyoming is 4.

This page describes the taxability of services in Wyoming including janitorial services and transportation services. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. See the publications section for more information.

Does Wyoming charge sales tax on vehicles. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Wyoming has among the lowest property taxes in the US.

Sales Tax by State. To the north Montana has no sales tax with the exception of some sales taxes levied on resorts. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties.

So if you live in Wyoming collecting sales tax is not very easy. Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

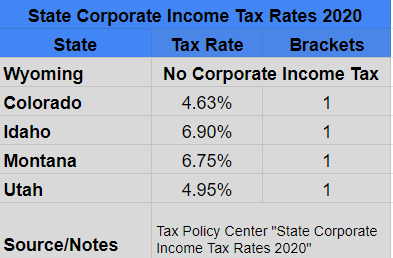

This page discusses various sales tax exemptions in Wyoming. Should You Charge Sales Tax on Digital Products. Unlike Wyoming which charges its highest property taxes on the mineral industry Montana does not levy a property tax on oil gas or coal holdings.

Sales and use tax in Wyoming is administered by the Wyoming Department of Revenue DOR. But if the vendor presents it as 195 for shampoo delivered then the full 195 is subject to Wyoming sales tax What does this mean. In fact at just 061 it has the eighth lowest average effective property tax in the country.

You must collect sales tax at the tax rate where the item is being delivered. This means that for each dollar spent on purchasing goods or services in Wyoming an additional 4. Shipping and handling charges are generally exempt in Wyoming when separately stated and distinguishable from any taxable charge that may appear on the same invoice.

The states with the lowest combined state and local sales tax rates are Hawaii Wyoming Wisconsin and Maine. Sales Use Tax Rate Charts Please note. Are services subject to sales tax in Wyoming.

Last updated March 2021. In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Wyoming Wy State Income Tax Information

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Business Guide To Sales Tax In Wyoming

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

States With Highest And Lowest Sales Tax Rates

Wyoming Income Tax Calculator Smartasset

Https Dcassetcdn Com Design Img 212759 79126 79126 2323252 212759 Image Jp Modern Business Cards Design Visiting Card Format Business Card Design Inspiration

Wyoming Sales Tax Small Business Guide Truic

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Income Tax Calculator Smartasset

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

I0 Wp Com Wyofile Com Wp Content Uploads 2017 0

Personal Property Taxes For Entrepreneurs Wyoming Sbdc Network

Wyoming Sales Tax Rates By City County 2022

These Are The Best And Worst States For Taxes In 2019